My spending report; how much do you need to be a nomadic adventurer?

It was great to receive such a positive response to My income report blog. And following on from lots of questions about my spending, I thought it would make sense to follow up with a spending report as well.

When I set out on my blogging journey I always said from the beginning that I wanted to be transparant about everything….even the awkward stuff like money. Because I remember starting out on this journey looking at others doing what I wanted to do and wondering…..how the hell do you do it? There’s no resources, no books or how–to-be-an-adventurer guide.

So whether you are on a mission to become an adventurer, a blogger, a digital nomad or are just a nosy git, I hope this blog will give you some insight.

I put this report together based on a year of spedning in 2018-2019. I didn’t keep an exact record of my expenses but am able to give examples of how a typical month of spending might look for me in a month as an adventurer.

My financial status

I’ll start by laying down my current financial status in 2018-2019….

Debt: the only debt I have is my Student Loan which I don’t need to start paying back until I’m earning over £21,000 a year. I’ve always been very good with money in the sense never had credit cards, learning to live within my means.

House: I don’t own any property. I’ve only ever rented flats or lived in home shares.

Car: I don’t own a car. I haven’t owned a car for nearly 10 years (doing my bit for the planet)

Savings: I have a modest amount of savings which I built up over the few years I was living in London – predominanatly my last year there (you can read about how I saved £8000 in a year here). Rather than buying clothes and eating out I prioritised saving. That gave me the flexibility to take a year off from work to go on adventures. During that time I began blogging and launched Love Her Wild and started making a career for myself as an adventurer. In my first 2 years building my brand, my spending and earnings were pretty much equal so I still have those savings as a safety net.

Business expenses: I have a number of on-going business expenses. Mainly hosting and domain fees, newsletter and social media services, insurance plus occasional marketing fees. I don’t have an office to work from so tend to find a library or coffee shop where ever I am as a temporary office. I don’t outsource much work but hope that will change soon!

Travel insurance: I need good insurance to cover me for all my travels and pay around £300 a year for this depending on what activities I do.

Dependants: I don’t have any children or dependents that I need to support.

Pension: I haven’t been paying into a pension for the last 3 years.

Tax: I’m registered as a sole trader so need to pay tax on any profits over £11,500.

Family support: I don’t receive regular financial support or a large trust fund from my family (or my husband’s). They do support us though by letting us stay for free or for low rent occasionally for short periods in between travels and adventures.

Partner: Gil is also building a career for himself online but currently I’m the higher earner….so no secret wealthy husband unfortunately 🙂

I’m feeling comfortable

I would describe my financial situation as comfortable. I’m certainly not wealthy enough not to have to worry about money. However, I am smart when it comes to saving and don’t have a house or car which I think are huge money eaters.

If everything goes wrong I know I have family who would take us in until I got myself back on my feet, plus I have my savings safety net which could keep us afloat for a good few months…..that net makes all the difference!

I’ve got nowhere to put it

Currently, I am completely nomadic so I travel full time and work almost entirely online. By default, I am a minimalist (although I also started practising minimalism before travelling….this is the best way to save monry, your soul and the planet!).

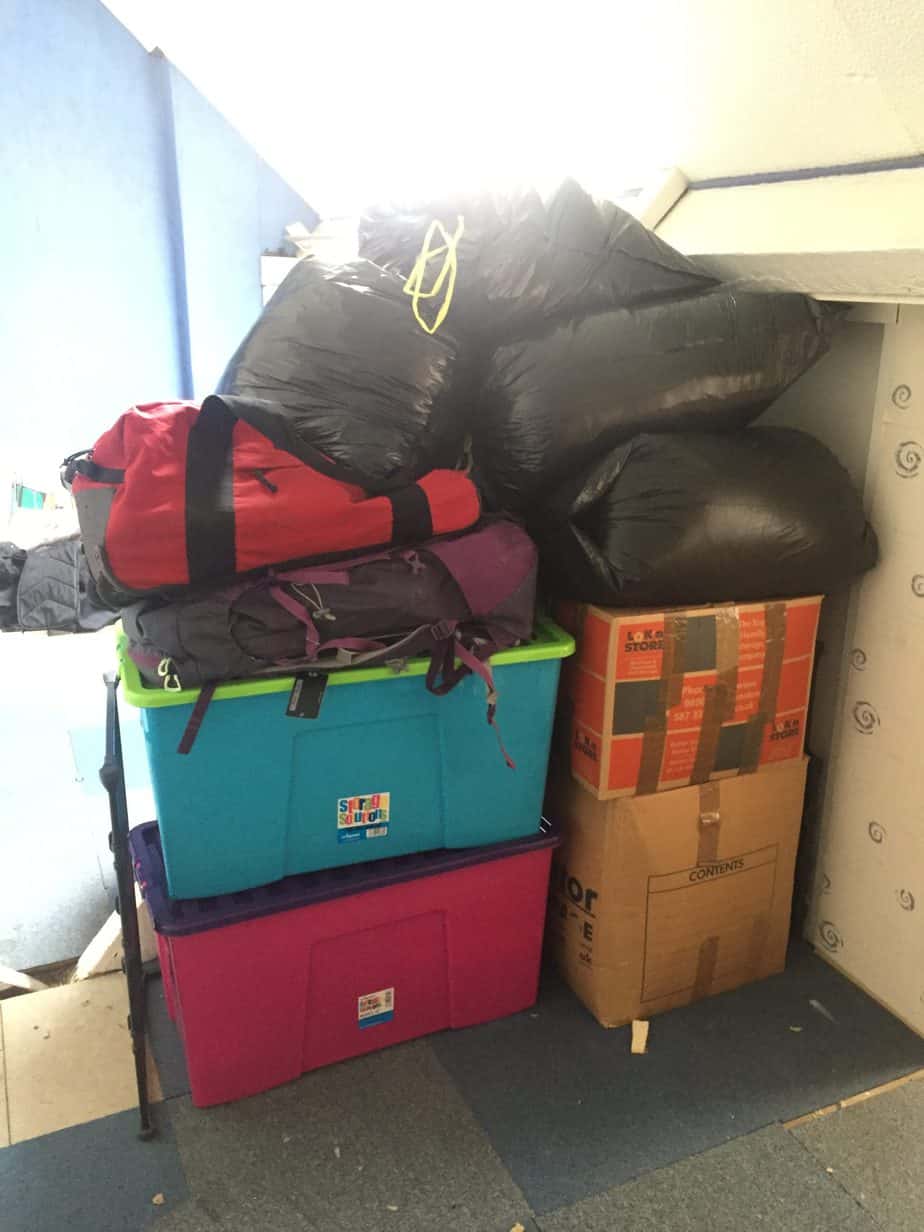

I live out of a bag and have very few possessions. The few boxes of stuff I own that I don’t carry with me live in my sister’s loft.

Being a minimalist really keeps costs down as I don’t buy things – by that I mean clothes, kitchen gadgets, beauty products, DVD’s, bags, watches, scented candles or jewellery. Even if I wanted these things I’d have nowhere to put them. It’s amazing how much money we can waste just buying ‘things’.

This is all of mine and Gil’s possessions. The boxes on the right have kitchen bits (for when we eventually stop for long enough to rent a place), paperwork and a few sentimental items. Boxes on the left are all outdoor and camping gear. Bags on top are our clothes, duvet and bedding….

My monthly living costs

Without renting long-term (or having the bills), this gives me the flexibility to adapt each month depending on the income I am earning. A month spent living in Honduras is considerably less then if we spent a month living in London.

It’s all about finding a balance though. While it can be great living in a developing country, eventually the lack of comfort, food options and slow wifi starts to grate and we miss friends and family.

To keep costs down we do the following:

- Use Airbnb to book affordable accommodation (normally if you stay for a few weeks or a month it is cheaper). Or look for local homestays which are always cheap. (If you’ve not used Airbnb before you can claim £34 off your first stay via this link)

- Cook for ourselves and eat a lot of street food

- Look for sponsorship opportunities or exchanging of services

I love a bit of sponsorship

Sponsorship plays a huge role in keeping my expenses down and allows me to travel all over the world taking on exciting adventures without paying for them.

I’m reluctant to use the word ‘free’ when describing sponsorship as I do have to work for them. In exchange for getting a product or service at no pay, I provide exposure on my blog and social media channels. You’ve also got to account for all the hard work I put in before now to build up my following and brand to what it is today.

Sponsorship can help cover the cost of hotels, adventurous activities, gear, flights and food. Sometimes I also get pay on top of a free service to cover transport or to take payment – escpecially in recent months since my blog and online following has started to grow in numbers.

When I’m working, everything is covered

If I work as an expedition leader or on a fully-sponsored adventure, all my expenses are covered.

As I don’t have many on-going monthly expenses (like a flat) that means that during those times I literally don’t spend a penny.

Check out how much do my expeditions cost for a detailed breakdown of my adventures and their budgets to give you an idea of how much money I might spend.

Examples of my monthly spendings

Here are examples of how all the above can work together to keep my spending down. These are just rough estimates based on budgets that I kept during my travels. My business expenses and insurance are not included in these examples….

November & December: Tanzania

Travel: £900 (total travel for flights and buses in the country was £900 but this was split between 2 months)

Accommodation: £145 (for the first month we stayed with a local while we volunteered in a school at a cost of £75 per person. We then went to Mafia Island where we stayed in a basic hotel for free in exchange for Gil building them a website. In between we stayed in a few hostels and basic hotels while travelling around)

Food & drink: £180 (mostly we ate in the local market which would cost $1-2 a meal)

Activities: free (mostly we did lots of hiking and relaxing on the beach. We also work with Afro Whale Shark on a conservation project so were able to join the whale shark and snorkelling tours for free in exchange for guiding the trips, teaching them English and helping with their website)

Total spending: £1125 or £562 per month

March: Brussels, Lisbon, Azores & Jordan

I had 2 big projects in March. The first was blogging about a trip with Biosphere Expeditions in the Azores. The second was hiking the length of the Jordan desert. I had a 10 day period before reaching the Azores that I needed to fill. I worked out that I could stop in Brussels & Lisbon along the way for the same price travel wise and also reduce my carbon footprint by slow travelling and getting a train part the way.

Travel: Free (covered by Biosphere Expeditions & sponsorship from the Hike Jordan expedition)

Brussels spending: £200 (spent a long weekend exploring with a friend)

Lisbon: £150 (hostel accommodation and an activity was sponsored)

Azores spending: Free (joined the conservation expedition in exchange for blogging and exposure)

Jordan spending: Free (covered by sponsorship from Tiso & Merrell supporting the Hike Jordan expedition)

Total spending: £350

Cheap months like these then allow me to spend a few weeks in the UK or travelling in places like the US following a trip. Basically in countries where spending is always much higher in terms of food and funding drinks in cafes while I work. A month in the UK or US would be much more likely to cost closer to £1000.

My spending

I’ve had to be very careful with money over the last couple of years while establishing my career as an adventurer. It’s not always easy being a digital nomad (as I explain in this blog) but it has also been a great experience. And while the annoying flies and slow WiFi in places like Tanzania drove me mad, making that compromise gave me the time I needed to build a career to a point where I can afford to support myself in the UK. Because in the end I decided I was done with full time travel.

Got a question? Ask in the comments box below.

If you found this blog helpful, please do follow my blog and adventures on Facebook, Twitter and Instagram. Or you can subscribe to my YouTube channel. I give all my advice out for free on my website. If you want to say thanks, you can buy me a coffee!

Any women reading this? I set up Love Her WIld – a women’s adventure community….we organise exciting adventures all over the world for you to join. Find out more – check out our private Facebook page.

Are you ready for an adventure?

I’m Bex Band, an award-winning author, speaker and founder of the women’s adventure community Love Her Wild. I’m passionate about adventure and conservation!

Thank you!

I mostly work from coffee shops. If you’d like to support my blog and work with a cup of tea just follow this link. Thank you! x

Popular Blogs

Awards